From Costly to Cost-Efficient: Saving Billions in Perpetual Funding with USDY

Just as in traditional markets, the derivatives market is a major segment within the digital asset ecosystem. To give an idea of its scale, in April 2023, Uniswap, one of the most popular decentralized spot exchanges, celebrated crossing $2 trillion in cumulative trading volume since its launch in 2018. By comparison, crypto derivatives volume averaged $2 trillion per month during the 2023 bear market.

Crypto derivatives markets enable traders to speculate on future price movements without needing to own the underlying assets. Traders use crypto derivatives to hedge their risk and express views — supporting the efficient functioning of the ecosystem.

An analysis of derivatives volume data from the 'big three' exchanges reveals that perpetual swaps account for 99% of the total derivatives volume. However, just like in traditional financial markets, there is a cost associated with this volume.

To execute a perpetual swap, a trader must deposit collateral with an exchange to open a position and pay a funding rate to maintain it. The collateral cost required to open and sustain these positions can be costly for the trader. Very costly.

Consider the roughly $3.69 trillion worth of perpetual swap value in May 2024. At a conservative estimate of a 5% margin rate, this represents over $180 billion in capital pledged as collateral. Traders putting up this capital bear a substantial cost.

Assuming a 5.3% yield from tokenized US Treasury Bills, which are considered the benchmark "risk-free rate," this $180 billion non-productive capital results in a $9.5 billion annual loss in potential yield accrual for traders. And this is not accounting for the funding cost traders have to pay to keep their positions open.

But it doesn’t have to be this way.

USDY as Collateral: Yield Offsetting Funding Cost

Unlike the significant opportunity cost incurred when using stablecoins as collateral in perpetual swap trading, USDY, a yieldcoin that provides exposure to US Treasury Bills, returns yield to its holders.

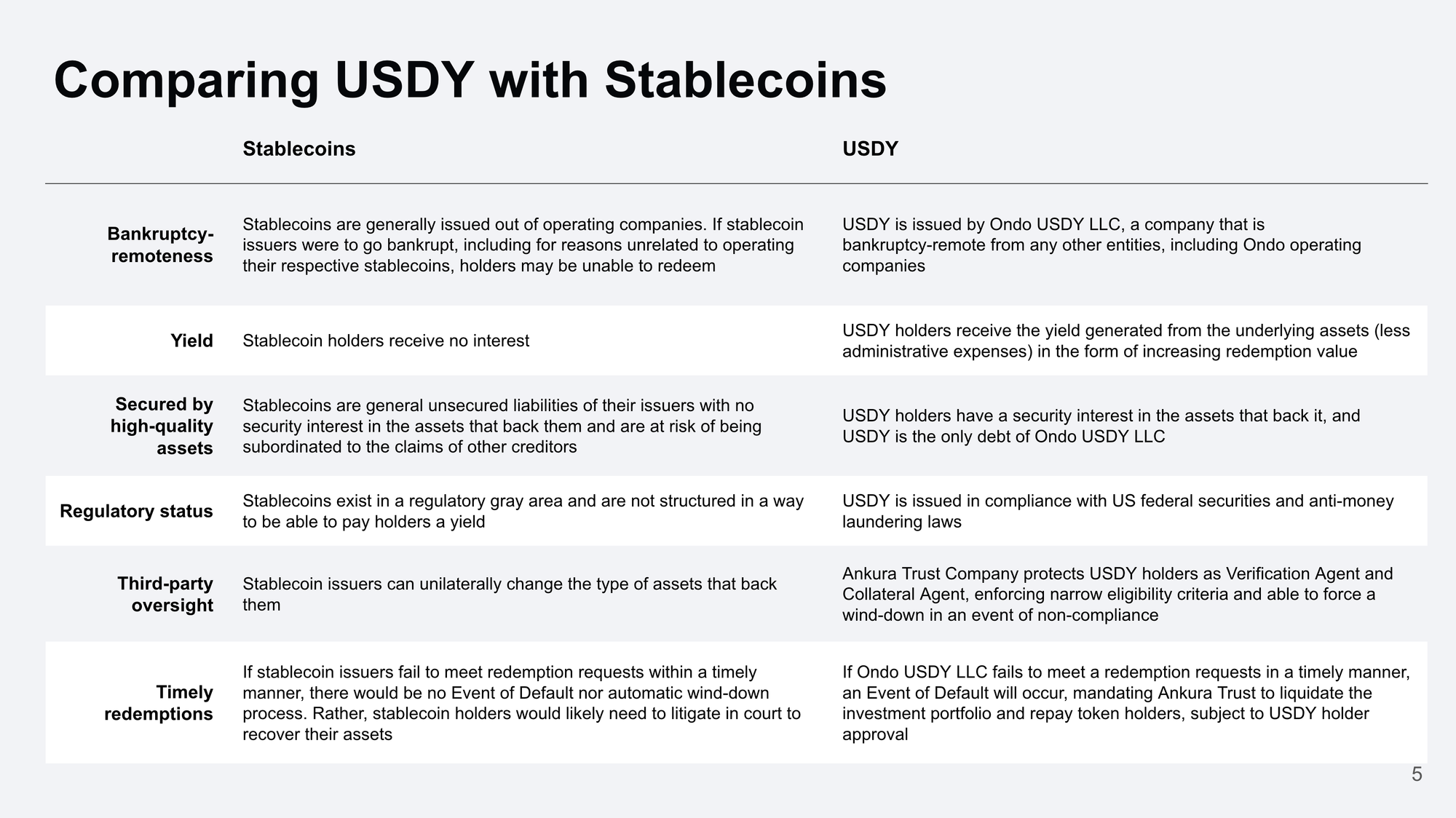

This enables traders to utilize the yield from USDY to offset funding costs, rather than covering these expenses out of pocket. The table below highlights the primary differences between USDY and stablecoins.

How does this translate for perpetual swap traders? Let’s consider an example:

A trader opens a $100 million perpetual swap position on an exchange. They are required to provide 5% of the total position value as collateral. Instead of depositing $5 million in stablecoins, they use $5 million of USDY.

Assuming an annual funding rate of 10%, it costs the trader $500,000 per year to maintain their position. If they were using stablecoins, they would need to pay this entire amount. However, by using USDY, they benefit from the yield backed by short-term US Treasury Bills. At the current 5.3% APY, their USDY would generate $265,000 per year, significantly offsetting the funding cost.

The end result? The trader saves $265,000 by using USDY as a superior form of collateral.

USDY as Collateral: Drift Moves First

Perpetual swap exchanges can offer a unique value proposition to traders by supporting USDY as a collateral asset, thereby enhancing collateral efficiency. Imagine two exchanges: one supports USDY, while the other does not. Which exchange is more attractive to traders?

We are thrilled to have recently announced that a leading perpetual swap platform on Solana, Drift, with over $28 trillion in trading volume, has enabled USDY as a collateral asset for its traders.

Marking the first time that yieldcoins can be used as collateral on a perpetuals platform, Drift now enjoys a first-mover advantage. This positions Drift to attract and retain users who recognize USDY as the preferred collateral solution for the onchain ecosystem of today and tomorrow.

Announcing the integration, Cindy Leow, Co-Founder of Drift stated, “Drift’s mission is to build a fully onchain platform where traders can trade any asset using any collateral. This partnership with Ondo Finance brings us closer to that vision, adding more utility to tokenized real-world assets and improving capital efficiency for traders.”

Justin Schmidt, President & COO of Ondo Finance, also expressed his excitement, noting, "Integrating $USDY with Drift significantly enhances capital efficiency for perpetual traders on Solana and marks a new era in DeFi.”

Fidelity International recently announced that it is tokenizing its money market fund and allowing it to be used as collateral. This move indicates a growing institutional emphasis on capital-efficient collateral management.

As the leading yieldcoin provider, Ondo Finance is witnessing growing demand for our capital-efficient onchain solutions, OUSG and USDY. This was recently demonstrated by Ondo Finance becoming the first tokenized US Treasuries provider to cross $500 million in TVL. If you would like to integrate our products, reach out to our team at partnerships@ondo.finance

⚠️ NOTE: USDY is not, and may not be, offered, sold, or otherwise made available in the US or to US persons. USDY has not been registered under the US Securities Act of 1933, a amended ("Act") or pursuant to securities laws of any other jurisdiction, and may not be offered, sold or otherwise transferred in the US or to US persons unless registered under the Act or an exemption or exclusion from the registration requirements thereof is available. Additional restrictions may apply. Ondo USDY LLC, the issuer of USDY, is not registered as an investment company under the US Investment Company Act of 1940, as amended. Nothing herein constitutes any offer to sell, or any solicitation of an offer to buy, USDY. Acquiring USDY involves risks. A USDY holder may incur losses, including total loss of their purchase price. Past performance is not an indication of future results. Ondo does not endorse, Ondo does not make any representation or warranty whatsoever (express or implied, including but not limited to any warranty of merchantability, fitness for a particular purpose or non-infringement) regarding, and ONDO SHALL NOT HAVE ANY LIABILITY WHATSOEVER WITH RESPECT TO ANYONE'S USE OF, any third-party products, services or technologies referenced herein. Additional terms apply. Visit http://ondo.finance/usdy for details.