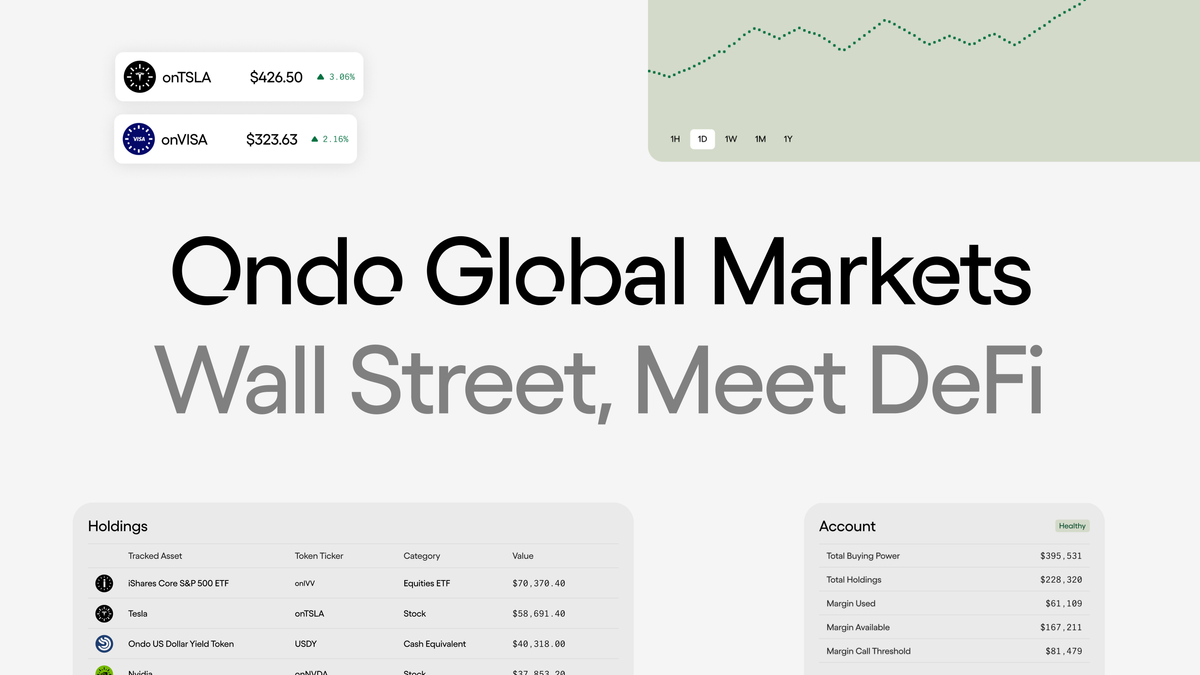

Ondo Global Markets: Wall Street, Meet DeFi

Yesterday, we wrote a blog post talking about our belief that now was the time to focus on bringing financial markets onchain. This article continues that series.

The current investing experience is broken. High fees, limited access, transfer frictions, platform fragmentation, and hidden risks create barriers for both investors and the companies that serve them. These problems have persisted for decades, locking millions out of capital markets and stifling innovation.

At Ondo, we believe there’s a better way. By leveraging blockchain technology, we can bring institutional-grade financial markets onchain, making them more accessible, transparent, and efficient. That’s why, last year, we announced our intention to build what we call Ondo Global Markets (Ondo GM), a tokenization platform designed to bring public securities onchain.

As we described last year, when we first began thinking about how to tokenize exposure to publicly traded securities, we knew we needed to design the tokens to have the same liquidity as the underlying assets. Initially, we planned to achieve this through a model where tokens would represent client instructions at traditional broker-dealers, in what would have been a fully permissioned system.

However, as we spoke more with key stakeholders—developers, TradFi partners, and current and former government officials—it became clear that the community was becoming increasingly ready to unlock the full potential of blockchain technology for financial markets through a more open and accessible design, with stablecoins as a key reference point.

Behind this momentum, we reimagined the Ondo GM tokenization framework, which now will enable issuers to create tokens that are more freely transferable, similar to stablecoins—with permissioning built into the distribution layer as needed for participants’ compliance, security or commercial purposes.

In this framework, Ondo GM will propel financial markets into the open economy, returning power to stakeholders to make their own decisions and compete on a level playing field, while addressing challenges like high fees, limited availability, and transfer frictions.

That’s why, today, we’re excited to share the next evolution of our Ondo Global Markets platform—with a tokenization framework that combines stablecoin-modeled transferability with the liquidity we have always envisioned. What stablecoins did for dollars, Ondo GM will do for securities.

Global Markets Overview

At its core, Ondo Global Markets is a tokenization platform that enables investors outside the US to gain onchain exposure to thousands of US publicly traded securities, including stocks, bonds, and ETFs. Tokens issued in the Ondo GM platform will be each backed 1:1 by an underlying asset, like a public stock, and will be freely transferable, like stablecoins, outside the US. By providing tokenized exposure to these assets, Ondo Global Markets brings the transparency, efficiency, and accessibility enabled by blockchain technology to institutional-grade finance. Through its APIs and SDKs, the platform also empowers third-party developers to build innovative financial applications, making it a cornerstone for the next generation of financial services.

Ondo Global Markets is designed to provide benefits to a wide range of stakeholders, including retail and institutional investors, traditional financial institutions, and crypto ecosystem participants:

- Individual investors outside the US can gain extremely low friction exposure to US securities in a manner that is as easy as acquiring a stablecoin, unlocking global participation in sometimes hard-to-access markets. These investors can also tap into onchain financial services across lending, trading, and derivatives, in many cases with rates typically only available to institutional investors.

- Traditional broker-dealers outside the US can leverage Ondo Global Markets as an alternative means of providing their clients with exposure to US securities, dramatically reducing operational complexity and cost compared to traditional brokerage-as-a-service alternatives. By integrating Ondo GM, these broker-dealers can also provide their users with services enabled by third-party protocols.

- Asset managers and other issuers gain a new distribution channel to a more global and onchain world of investors, and the ability to bring new assets onchain. Investment advisers, including robo-advisors, can also leverage onchain financial infrastructure to transparently manage funds backed by tokenized securities.

- Existing crypto-focused platforms, including wallets, protocols, and exchanges benefit from the ability to offer their users, in many cases for the first time ever, exposure to high-quality traditional securities that have historically been unavailable onchain (subject to applicable regulatory requirements). Users of these platforms may be particularly drawn to the ability to leverage crypto and securities together, such as for loans and derivatives positions with cross-collateralization.

Features

Here’s some of the key features the Ondo GM platform—and our web app—will offer:

- Broad Access to Thousands of RWAs: Gain exposure to over one thousand high-quality securities listed on the NYSE and NASDAQ, including equity and fixed-income ETFs (e.g., SPY, QQQ, TLT) and individual stocks of companies like Apple, Tesla, and Uber. Each token is backed 1:1 by the security it tracks.

- Global, 24/7/365 Availability: Mint, redeem, and transfer tokens from anywhere in the world (outside the US) at any time , ensuring continuous access to high-quality RWAs.

- Instant Minting & Redemption: Mint and redeem tokenized securities instantly.

- Full Liquidity: Ondo GM assets are designed to have the same liquidity as the underlying security, allowing for immediate, low-slippage buying and selling.

- Built-In Access to Margin: Borrow against tokenized holdings at competitive rates typically accessible only to traditional institutional investors.

- Onchain Financial Services: Tap into a wide range of onchain financial protocols across trading, lending, and derivatives, applying the transparency and composability of DeFi to traditional assets.

- Additional Yield Opportunities. Earn novel sources of yield by pledging tokens as collateral to secure onchain financial infrastructure, including chains, oracles, and bridges.

- Freely Transferrable Tokens: Transfer tokens freely on secondary markets outside the US, utilizing them across various onchain protocols and wallets without any platform lock-in.

- Institutional-Grade Investor Protections: Benefit from robust legal structures designed to maximize bankruptcy remoteness while providing token holders with security interests in the assets that back tokens.

- Income from Securities Lending: Earn additional income by opting in to allow the securities that back your tokens to be lent out in the institutional securities lending marketplace, while avoiding the added risk by knowing your securities won’t be lent out unless you explicitly opt in.

- Comprehensive APIs: Integrate with powerful APIs that let brokers, asset issuers, and other platforms build on top of Ondo GM, reducing costs, modernizing back-end infrastructure, and enhancing user experiences.

Solving the Challenges of Traditional Capital Markets

With the above features, it should be clear that Ondo GM was designed from the beginning to address many of the issues that end investors face in today’s traditional capital markets:

Accessibility and Cost

- The Problem: Many investors around the world face hurdles accessing US financial products and services. Even when able to access them, brokerage platforms often require high minimum balances or fees, making investing impractical for many.

- The Solution: With Ondo GM, anyone outside the US in eligible geographies can get exposure to thousands of US securities—AAPL, TSLA, SPY, QQQ, etc.—with minimal fees using stablecoins, removing traditional cost and geographic barriers.

Platform Lock-In

- The Problem: Those investors who do manage to get an account with access to US capital markets experience a high degree of lock in to a specific platform. The platform determines your monthly fees, your trading fees, your access to specific products (e.g., Vanguard funds vs. BlackRock funds, crypto vs. equities, etc.) and services, and the margin rates you receive on your capital. Changing platforms is possible, but broker to broker transfers are very cumbersome and slow.

- The Solution: Ondo GM tokens are freely transferable outside the US, allowing investors to easily transfer their holdings to any wallet or platform (including protocols) at any time. Transfers happen instantly, 24/7/365, eliminating platform lock-in and enabling a seamless, global investing experience across platforms. You can also easily use different protocols for trade execution, leverage, and other services, and you can compose different activities from different protocols together (taking advantage of the “money legos” that DeFi is well-known for).

Platform Fragmentation

- The Problem: Securities held at different brokerages are generally not interoperable. For example, for a retail investor, there isn’t a great way to cross-collateralize a loan or derivatives position with assets held at different brokerages (let alone with assets held at different brokerages, banks, crypto exchanges, etc.). This stems in part from the fact that different platforms hold user balances on siloed books and records.

- The Solution: Ownership of Ondo GM tokens is recorded on the blockchain, and with your approval, you can grant different platforms the ability to buy, sell, lend, borrow, and take other actions utilizing your assets. Your assets are truly interoperable and you do things like take out a leveraged trade cross-collateralized by your assets held at a variety of different locations.

Limited and Costly Margin

- The Problem: For many retail investors outside the US, margin options—the ability to borrow money against your portfolio—are particularly expensive and limited (if available at all). For investors who hold both traditional and crypto assets, it’s often not possible to borrow against one set of assets in order to purchase assets in the other. Additionally, due to platform lock-in, investors aren’t able to easily shop for different margin rates unless they want to change brokerages entirely.

- The Solution: Ondo GM integrates institutional-grade borrowing options directly into its platform. Investors can borrow against their tokenized holdings via third party protocols or directly via the Ondo GM platform. Investors can also cross-collateralize their positions by tokenized securities as well as crypto.

Hidden Risks

- The Problem: Many platforms lend out client securities without clear disclosure, exposing investors to hidden risks. Yield from these activities often goes entirely to the platform, not the client.

- The Solution: Securities are never lent out without explicit investor permission — and for clients who opt in, they earn 100% of the yield generated.

US Markets. Global Access.

While the Ondo GM platform is certainly not limited to tokenizing US securities, it’s no accident that we’re starting here. In many respects, US capital markets are the envy of the world: over the past 25 years, US public securities have outperformed nearly every other major market by a considerable margin. US equities historically have also acted as an effective inflation hedge, far outpacing global inflation by about 4.5% on average over the past 50 years. While the US dollar is often in the spotlight due to its position as the world’s reserve currency, it is US capital markets (along with crypto more recently) that have been the real driver of wealth creation long term. By increasing accessibility to high-quality US financial assets and services, we believe Ondo GM will mark a significant step forward in making markets more open to all.

A New Era of Investing

We intend to launch Global Markets this year. When we do, we will take a significant step toward our goal of making capital markets accessible to everyone and catalyzing the growth of the open economy.

But that’s not all.

In the process of figuring out how to best achieve our ultimate goal, we realized two additional points. First, given the unique challenges associated with tokenizing RWAs, the infrastructure to ensure the level of security, reliability, compliance, cost, and convenience we wanted doesn’t yet exist. Second, bringing financial markets onchain is too big an undertaking to do by ourselves: it takes the support and work of many key partners to build an ecosystem to help bring this all to life.

Over the past year or so, we’ve been working hard to bring together all three pieces—not just the assets, but also the infrastructure and the ecosystem—to make this vision a reality. In the next few days, we’ll be making a major announcement that will tie all of these pieces together and lay out our full vision for the future of financial markets. Stay tuned.