Ideal Collateral for Decentralized Lending

Flux Finance’s introduction of DeFi loans collateralized by US Treasuries represents a groundbreaking development for the crypto industry. Why is this, and how does lending against US Treasuries collateral compare to lending against other types of crypto collateral, such as Bitcoin or stablecoins? Before delving deeper, let's revisit what Flux Finance does and the ideal characteristics of loan collateral.

The Flux Finance lending protocol & Ondo Finance’s tokenized Treasuries

Flux is a revolutionary decentralized lending protocol, designed to bridge the gap between on-chain and off-chain yields.

The Flux protocol offers meaningful yield to lenders who loan stablecoins (including USDC, USDT, DAI, and more) to over-collateralized borrowers. Borrowers pledge Ondo Finance’s OUSG (Ondo’s Short-Term US Government Bond Fund) as collateral for the loan. OUSG is currently exclusively backed by Blackrock’s iShares Short-Term Treasury Bond ETF (SHV) and is currently yielding 4.77%.

In essence, Flux is a repo market that exclusively accepts short-term Treasuries as collateral for stablecoin-based loans.

What is ideal collateral for decentralized lending? (Hint: it’s OUSG.)

Simply put, ideal collateral should meet the requirements of both borrowers and lenders. These requirements have both financial and utility components.

From a financial perspective, ideal collateral should:

(a) Be relatively stable price-wise – A material drop in the value of the collateral can cause a loan to become under-collateralized, an undesirable outcome for both sides

(b) Be highly liquid – For the lender, monetizing collateral in the event of a liquidation should be as efficient as possible

(c) Offer yield – For the borrower, pledging an asset that offers yield means their money works for them, even while utilized as collateral

From a utility perspective, the collateral should be easily transferable, divisible, and accessible 24/7.

In traditional finance, short-term US Treasuries are the ideal financial instrument for use as collateral. By tokenizing short-term US Treasuries, Ondo has brought the AAA-rated characteristics of one of the most low-risk and most liquid assets in the world into a transparent, auditable, 24/7 environment.

In summary, Ondo’s OUSG brings familiar, ideal financial collateral to DeFi.

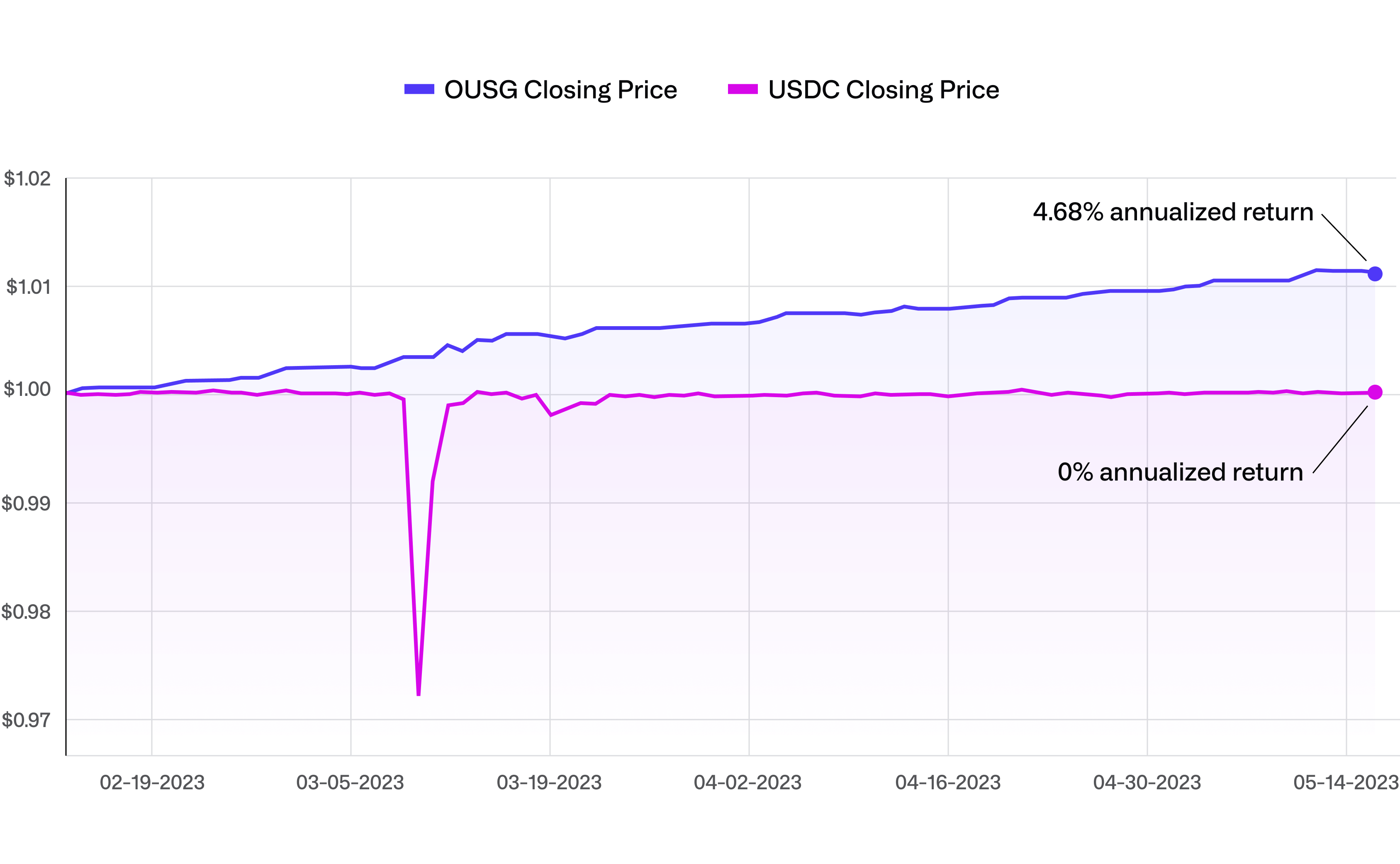

Collateral comparison – OUSG vs USDC

USDC is a permissionless stablecoin issued by Circle that is pegged to the US dollar, designed to have low price volatility. Nonetheless, its value dropped as low as 87 cents in March when some of the assets backing the stablecoin were embroiled in Silicon Valley Bank’s FDIC receivership. An event like this can trigger issues for both token holders and protocols that rely upon stability. USDC provides excellent utility around payments, but it does not offer native yield resulting in a capital-inefficient form of collateral.

Yield vs No-Yield

In contrast, Ondo’s OUSG provides exposure to short-term US Treasuries, which have historically remained steady in price while currently paying out 4.77% in yield. OUSG’s underlying ETF has over $23b in AUM and averages over $400m in daily trading volume.

Protecting investor assets via superior legal structure

Ondo designed OUSG’s legal structure protect the investor. OUSG is issued by a separate company, called Ondo I LP, that is bankruptcy remote from our operating company, Ondo Finance, Inc. USDC is not bankruptcy remote from its issuer, Circle. USDC is issued out of Circle’s operating company, and in the event of a Circle bankruptcy, assets backing USDC would be commingled into the bankruptcy estate along with other creditors. On the other hand, the assets backing OUSG are wholly-owned by token holders and not rehypothecated. Thus – even in the unlikely event of an Ondo Finance, Inc bankruptcy – OUSG assets would be safe, and tokens would remain fully backed.

Collateral comparison – OUSG vs BTC

Like many cryptocurrencies, BTC’s price is exclusively determined by supply and demand rather than fundamentals, resulting in unpredictable price volatility. This makes BTC (and other comparable assets such as ETH) a challenging instrument to use for collateral. Due to this volatility, borrowers collateralizing with BTC will be offered lower loan amounts against the value of their collateral, compared to more stable assets. On Compound, wrapped BTC has a maximum loan-to-value ratio of 70%.

In contrast, Ondo's OUSG stands at the opposite end of the volatility spectrum, enabling a much higher loan-to-value ratio of 92% on Flux. This, combined with OUSG earning native yield, has benefits for both borrowers and lenders. Borrowers are able to borrow more against the value of their assets, and lenders receive higher rates of interest, partially due to OUSG’s native yield.

Flux is currently yielding approximately 4% at the target lending utilization rate of 90%. On Compound, lender yields – collateralized by a portfolio of crypto assets – are only 2.3%.

Summary

Flux offers a better experience for both borrowers and lenders compared to other protocols. Lenders receive higher interest rates, partially because borrowers are receiving interest on their collateral while it is pledged. Borrowers get better capital efficiency due to Flux’s higher LTV ratio. This is in no small part due to Flux’s choice to collateralize loans with OUSG, an ideal form of collateral.

Learn More and Contact Us

Explore Ondo: https://ondo.finance/

Explore Ondo’s OUSG token: https://ondo.finance/ousg

Explore Flux: https://fluxfinance.com/

Explore Flux’s markets and current yields: https://fluxfinance.com/markets

Join Us

If you would like to learn more or have any questions, comments or ideas, we would love to hear from you. Join the Ondo DAO community in Discord and follow Ondo and Flux on Twitter via @OndoFinance and @FluxDeFi.