Ondo Monthly Spotlight: May 2024

Welcome to the Monthly Spotlight from Ondo Finance, where we delve into the latest developments from the forefront of real-world asset tokenization. This month, Ondo Finance became the market leader for tokenized US Treasuries, and implemented multiple product enhancements across both USDY and OUSG, ensuring that our offerings remain best-in-class.

May Spotlights ⬇️

- 🏆 Ondo Finance Becomes Leading Tokenized US Treasuries Provider

- 💸 OUSG Instant Mint/Redeem Goes Live On Ethereum Mainnet

- 🚀 rUSDY Goes Live on Ethereum Mainnet

- 🏦 Institutional Insights on Tokenization

- 🌐 Ondo Ecosystem Expansion

- 🤠 Ondo Finance at Consensus

🏆 Ondo Finance Becomes Leading Tokenized US Treasuries Provider

TVL across Ondo Finance’s yield-bearing products surpassed $420M, making us the leading tokenized US Treasuries provider. Since this milestone was crossed, TVL has grown to $465M, demonstrating continued demand for high-quality yieldcoins. Thank you to all of our fantastic partners and clients for your contributions toward this growth.

💸 OUSG Instant Mint/Redeem Goes Live On Ethereum Mainnet

24/7/365 minting and redeeming for OUSG is now live, with new, lower minimums for instant transactions. In addition, we launched a new form of OUSG – rOUSG – with a constant $1.00 per share mint/redeem price, with yield distributed each business day in the form of increased rOUSG token balances via token rebasement. Finally, investors can easily and instantly convert between OUSG and rOUSG using the conversion tool on our website (and onchain).

🚀 rUSDY Goes Live on Ethereum Mainnet

rUSDY, a new form of USDY, is now live on Ethereum Mainnet. Yield on Mainnet USDY can now be paid out in either an accumulating or distributing form. USDY is an accumulating token where the yield accrues daily via an increasing redemption value per token. The quantity of tokens in the holder's wallet remains the same, while the redemption value per token increases.

rUSDY, on the other hand, is a distributing token where the yield accrues daily via additional tokens distributed to the holder's wallet. The redemption value per token remains at $1.00, while the amount of tokens increases. Tokenholders can convert between these two forms of USDY at any time, and with zero slippage by using the conversion tool on our website.

🏦 Institutional Perspectives On Tokenization

Very few people in the tokenization space possess deep knowledge of both the institutional and digitally native facets of the industry. Ian De Bode, Chief Strategy Officer of Ondo Finance, is one of the few who does. Prior to joining Ondo, he spent years as a partner and the Head of Digital Assets at McKinsey, engaging, educating and supporting C-Level executives on tokenization business initiatives. We recently sat down with him to discuss his perspective on tokenization and to explore the most significant challenges and opportunities facing the industry. Continue Reading.

🌐 Ondo Ecosystem Expansion

The Ondo Ecosystem Directory – a list of the institutions, protocols, and networks aligned with our mission of delivering institutional-grade financial products onchain continues to expand. Notably, ether.fi and Zebec Network joined the Ondo Ecosystem this month.

Sam Thapaliya, Founder of Zebec remarked, "This integration marks a significant advancement in our shared quest to redefine financial ecosystems globally. By incorporating USDY, a market-leading tokenized real world asset, we further enhance Zebec’s product suite, empowering businesses and individuals to manage their finances with unprecedented immediacy and efficiency."

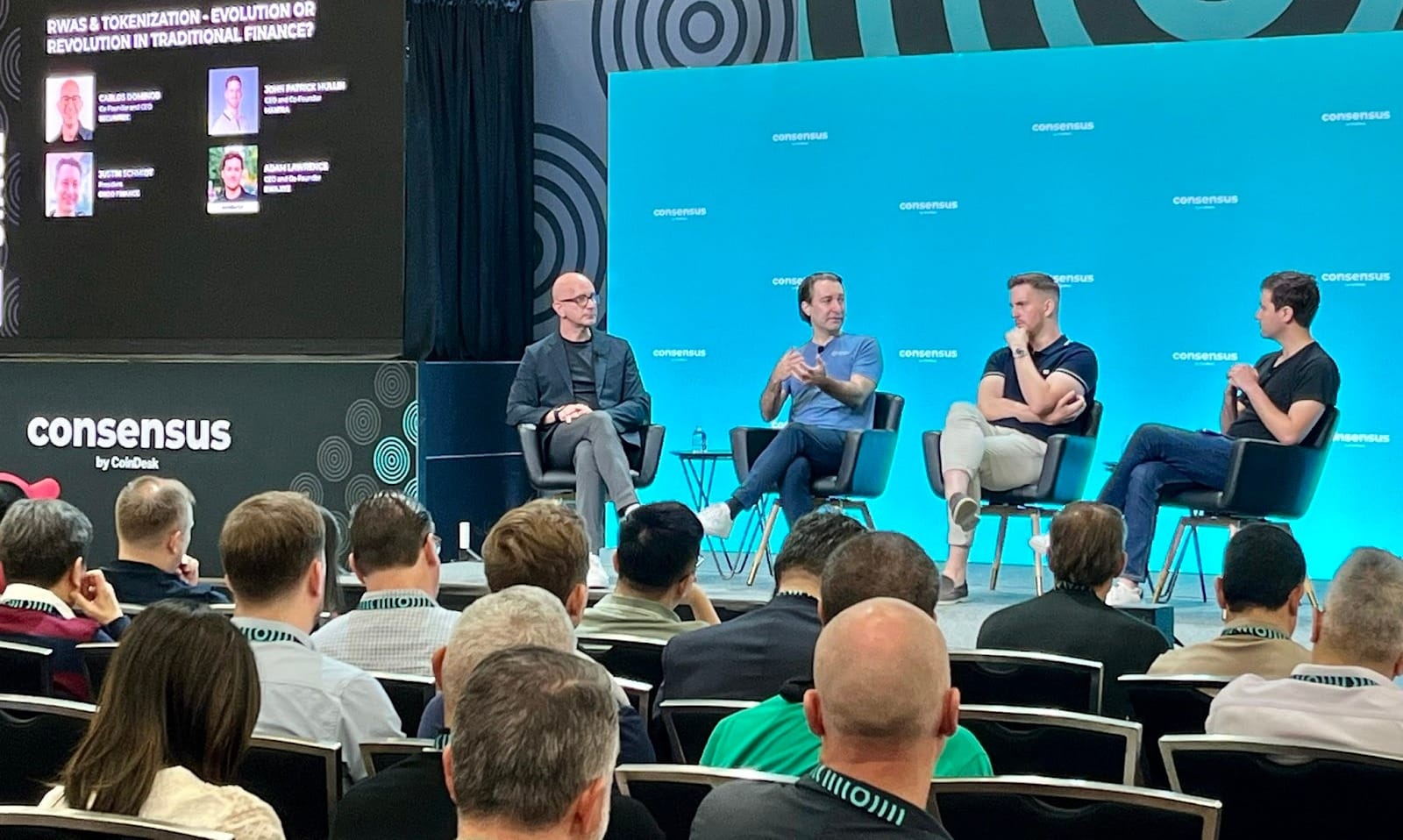

🤠 Ondo Finance at Consensus

Ondo Finance President & COO, Justin Schmidt reported “exciting energy” at CoinDesk's Consensus in Austin – There was standing room only during our panel on tokenization, which also included Carlos Domingo, Co-Founder and CEO of Securitize, John Patrick Mullin, Co-Founder and CEO of MANTRA, and Adam Lawrence of RWA xyz.

Justin also joined a second esteemed panel, “What's next for TradFi”, joined by Jordi Alexander, CEO of Selini, Brian Fabian Crain, CEO of Chorus One, and Annelise Osborne, Author and CBO of Kadena. Stay tuned for the upcoming highlights of both panels!

-

⚠️ Important: USDY is not, and may not be, offered, sold, or otherwise made available in the US or to US persons. USDY also has not been registered under the US Securities Act of 1933. Important: USDY is not, and may not be, offered, sold, or otherwise made available in the US or to US persons. USDY also has not been registered under the US Securities Act of 1933. Important: USDY is not, and may not be, offered, sold, or otherwise made available in the US or to US persons. USDY also has not been registered under the US Securities Act of 1933.