Ondo Monthly Spotlight: November 2024

Welcome to the Monthly Spotlight from Ondo Finance, where we delve into the latest developments from the forefront of real-world asset tokenization. This month, Ondo was proud to collaborate with PayPal, and launched a first-of-its-kind institutional-grade bridging solution for tokenized real-world assets.

November Spotlights ⬇️

- 🌆 Wall Street 2.0 is Coming

- 🤝 Ondo is Enabling 24/7 Conversions Between OUSG and PayPal USD (PYUSD)

- 🌉 Ondo Launches Institutional-Grade Bridge, Leveraging LayerZero

- 📊 The Most Widely Held Tokenized US Treasuries Products

- 🎤 Justin Schmidt Speaks at The Federal Reserve Bank of Philadelphia's Fintech Conference

- 🌱 The Growth of Yieldcoins

🌆 Wall Street 2.0 is Coming

The next era of finance will be revealed at our first-ever Ondo Summit. We can’t wait to show you what’s next. Save the date.

🤝 Ondo is Enabling 24/7 Conversions Between OUSG and PayPal USD (PYUSD)

Investors will soon be able to seamlessly convert in & out of Ondo's OUSG with PYUSD, one of the fastest-growing stablecoins, enhancing redemption liquidity and expanding the utility of PYUSD as a liquidity source for RWAs. Continue reading.

PayPal USD (PYUSD) is coming to @OndoFinance!

— PayPal (@PayPal) November 18, 2024

We are excited to announce that Ondo Finance, a pioneer in the tokenization of real-world assets, will enable 24/7 conversions between Ondo OUSG and PYUSD. Learn more: https://t.co/Kwu1M2OQ5X https://t.co/sDQEDriFmJ

Jose Fernandez Da Ponte, SVP & GM of Blockchain, Crypto & Digital Currencies at PayPal, commented “We are excited to further enhance the utility of PYUSD as a liquidity source for RWAs. What Ondo Finance is doing is the perfect illustration of the inherent advantages that PYUSD enables for fast and cheap settlements beyond commerce payments.”

🌉 Ondo Launches Institutional-Grade Bridge, Leveraging LayerZero

Ondo is a provider of institutional-grade assets building toward a global market for tokenized securities, and as such, investor protections are paramount. The fragmented, multichain nature of blockchain ecosystems means that onchain tokenized assets must be able to seamlessly bridge across isolated blockchains. This requires solutions that ensure security-first, cross-chain transferability. Continue reading.

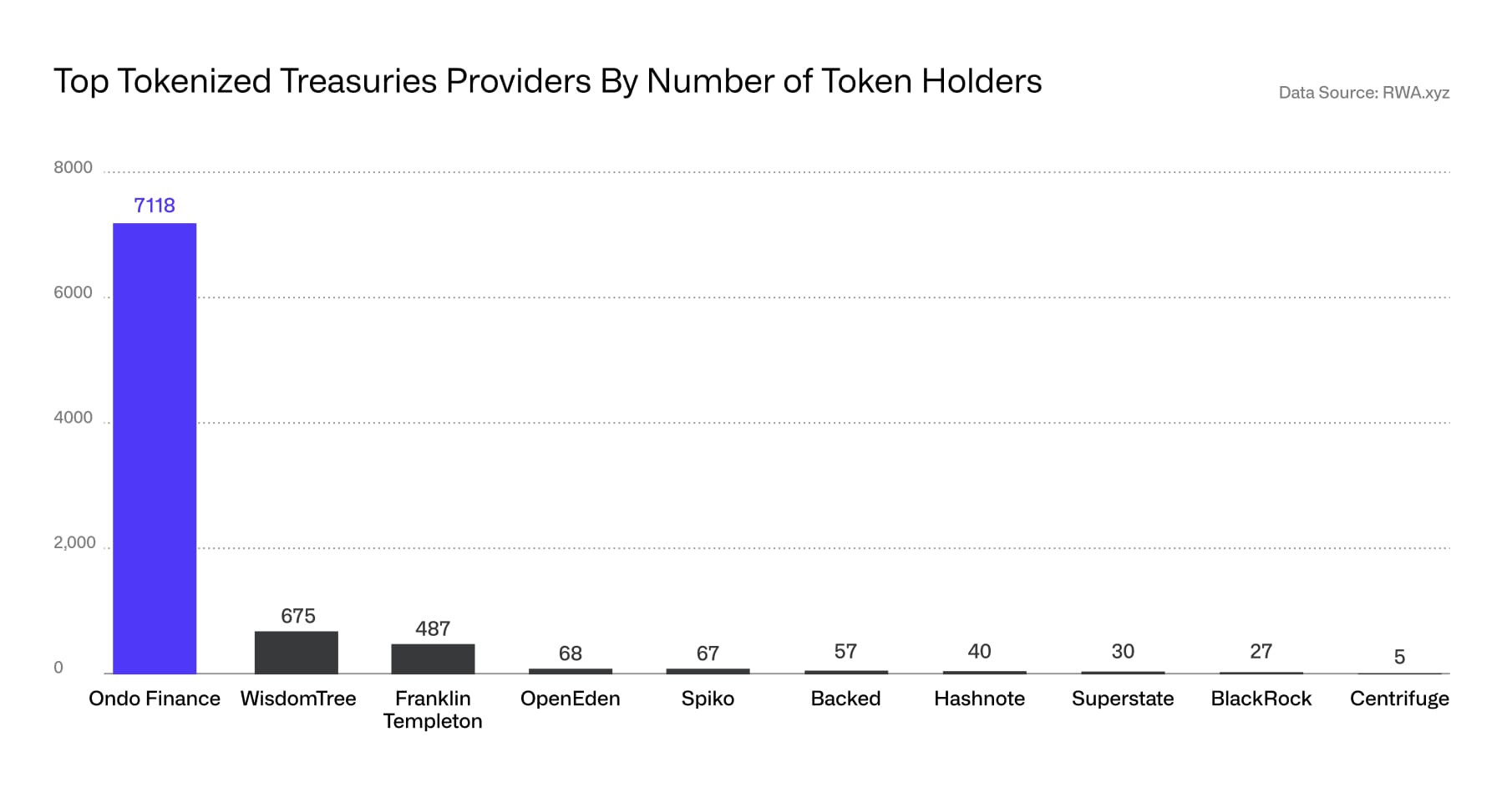

📊 The Most Widely Held Tokenized US Treasuries Products

Ondo Finance's products are the most widely held tokenized US Treasuries products. With over 7,000 wallets holding our products, Ondo's assets account for an 86% market share by number of holders. Learn more.

🎤 Justin Schmidt speaks at The Federal Reserve Bank of Philadelphia's Fintech Conference

Justin Schmidt, President & COO of Ondo Finance, spoke at The Federal Reserve Bank of Philadelphia's Fintech Conference on 'Next-Gen Finance Through Real-World Asset Tokenization.' Watch to learn how Ondo's tokenized assets enhance finance with features such as 24/7 instant redemptions, and flexible token forms tailored to different use cases.

🌱 The Growth of Yieldcoins

Today, let's explore something fascinating happening in DeFi -- the growth of yieldcoins.

— Solana (@solana) November 29, 2024

Imagine if your coins were instead assets that could earn interest just sitting in your wallet. Not in a lending pool, not staked -- just earning yield automatically 🤯

This is what…

Imagine if your coins were instead assets that could earn interest just sitting in your wallet. Not in a lending pool, not staked – just earning yield automatically. Continue reading.