Ondo Monthly Spotlight: September 2024

Welcome to the Monthly Spotlight from Ondo Finance, where we delve into the latest developments from the forefront of real-world asset tokenization. This month, Ondo Finance was proud to collaborate with BlackRock and Securitize, and became the first tokenized treasuries provider to surpass $600M in TVL.

September Spotlights ⬇️

- 🤝 Ondo Finance, BlackRock & Securitize Collaborate For Tokenization Grand Prix

- 📈 Ondo Finance Becomes First Tokenized Treasuries Provider To Surpass $600M TVL

- 🔍 Introducing Know Your Ecosystem (KYE)

- 🚀 Why the Fed’s Rate Cuts Could Supercharge Yieldcoin Adoption

- 📊 TAC Welcomes 21 New Members & Releases Tokenization Report

- 🔦 Arbitrum Ecosystem Spotlight: USDY on Dolomite

- 🎤 Justin Schmidt Joins Token2049 Main Stage Panel

- 📆 Upcoming Events

🤝 Ondo Finance, BlackRock & Securitize Collaborate For Tokenization Grand Prix

Ondo Finance is proud to have collaborated with BlackRock and Securitize to submit the OUSG proposal to Sky's (MakerDAO) Spark Tokenization Grand Prix, which aims to onboard $1B in tokenized financial assets. Continue Reading.

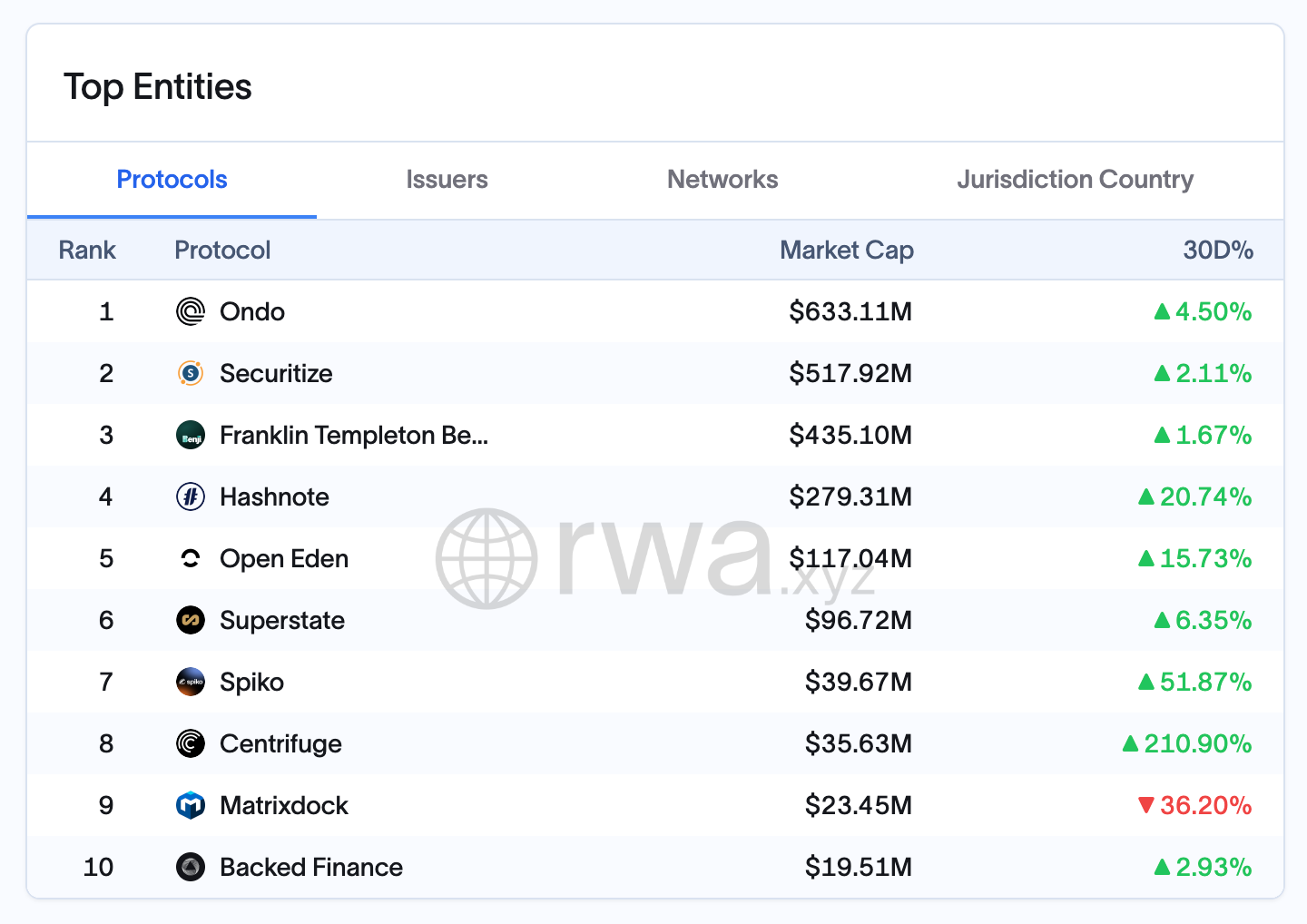

📈 Ondo Finance Becomes First Tokenized Treasuries Provider To Surpass $600M TVL

Ondo Finance celebrated a new milestone, having surpassed $600M in TVL across our yield-bearing products. We’re proud to be the first issuer of tokenized treasuries to achieve this milestone. Continue Reading.

🔍 Introducing Know Your Ecosystem (KYE)

As the digital landscape grows more complex, token issuers are taking the next step in AML risk management. Enter Know Your Ecosystem (KYE). KYE leverages cutting-edge blockchain analytics to evaluate risk not just at the level of individual customers or transactions, but across the entire ecosystem in which a token operates. Continue Reading.

🚀 Why the Fed’s Rate Cuts Could Supercharge Yieldcoin Adoption

The Federal Reserve cut rates by 50bps. We believe this is the start of an accelerated growth phase for tokenized treasuries. Here’s why. Continue Reading.

📊 Tokenized Asset Coalition Releases State of Tokenization Report

The Tokenized Asset Coalition, of which Ondo Finance is a member, welcomed 21 new members and unveiled its second State of Tokenization report. The report examines the crucial role of regulation in driving adoption, growing institutional interest, and key industry innovations. Notably, it highlights the significant growth of tokenized US Treasuries, where Ondo Finance has been leading the way. Continue Reading.

🔦 Arbitrum Ecosystem Spotlight: USDY on Dolomite

Arbitrum is home to over $14b in DeFi TVL, establishing itself as a cornerstone of the evolving DeFi landscape. Part and parcel to this evolution is the ability to innovate atop existing financial tools with creative solutions enabled by blockchain rails. This includes a new exploration of utility for tokenized treasuries. Continue Reading.

🎤 Justin Schmidt Joins Token2049 Main Stage Panel

Ondo Finance team members participated in 12 panels throughout September across Korea Blockchain Week and Token2049. Watch Ondo Finance's President & COO, Justin Schmidt, on the main stage at Token2049, where he joined Sergey Nazarov and Carlos Domingo for a panel discussion on 'Redefining Ownership: Tokenization & Next-Generation Markets.'

📆 Upcoming Events

Conference season is in full swing and the Ondo Finance team will be speaking at numerous events throughout October.

- Mainnet (Oct 1): Justin Schmidt, Ondo's President, will speak at Messari Mainnet on a panel “Are RWA’s Still Hot?"

- TradFi Meets Blockchain Policy Summit (Oct 10): Chris Tyrell, Ondo's Chief Compliance Officer, joins Capitol Asset Strategies' event on a panel "Tokenized Funds: What are the Regulatory Challenges in the US and Europe?"

- Eighth Annual Fintech Conference by Federal Reserve Bank of Philadelphia (Oct 22): Justin Schmidt joins a panel “Next-Gen Finance Through Real-World Asset Tokenization”

- Digital Assets USA 2024 (Oct 22): Ian De Bode, Ondo's Chief Strategy Officer, will join a panel “Tokenization & its Implications – A New Frontier in Your Digital Asset Future”, alongside panelists from BlackRock, Northern Trust, and more

⚠️ NOTE: Neither USDY nor OUSG has been registered under the US Securities Act of 1933 ("Act") or pursuant to securities laws of any other jurisdiction, and neither may be offered, sold or otherwise transferred in the US or to US persons unless registered under the Act or an exemption or exclusion from the registration requirements thereof is available. Additional restrictions may apply. Neither Ondo USDY LLC nor Ondo I LP, the respective issuers of USDY and OUSG, is registered as an investment company under the US Investment Company Act of 1940, as amended. Nothing herein constitutes any offer to sell, or any solicitation of an offer to buy, USDY or OUSG. Acquiring tokens, including USDY and OUSG, involves risks. A holder of such tokens may incur losses, including total loss of their purchase price. Past performance is not an indication of future results.

Ondo does not endorse, Ondo does not make any representation or warranty whatsoever (express or implied, including but not limited to any warranty of merchantability, fitness for a particular purpose or non-infringement) regarding, and ONDO SHALL NOT HAVE ANY LIABILITY WHATSOEVER WITH RESPECT TO ANYONE'S USE OF, any third-party products, services or technologies referenced herein. Additional terms apply. Visit http://ondo.finance/usdy for details.