Wall Street 2.0: Towards the Open Economy

Today’s financial markets are a remarkable achievement, refined over centuries to fuel economic growth, enable wealth creation, and expand opportunities for millions worldwide. Yet despite these advancements, significant limitations persist: high costs, limited transparency, slow settlement, restricted market hours, and siloed systems that fragment user experiences and constrain innovation.

These limitations have consequences. Consider the experience of a Millennial investor here in the US. She might have cash at Bank of America and Chase, meme stocks at Robinhood, mutual funds in her retirement account at Fidelity, a diversified portfolio at Wealthfront, leveraged stocks at Interactive Brokers, and crypto at Coinbase. For her, trying to move assets between these platforms is difficult and slow. Even just getting a ‘unified view’ of all her assets is difficult. And if she wants to cross-collateralize her assets held on different platforms or shop around for the best leverage rates? Good luck. Each of these platforms keeps records of user ownership in siloed systems, while the underlying bank deposits, securities, and crypto settle on a distinct set of rails. This fragmentation makes the entire experience cumbersome, costly, and slow.

While these challenges are frustrating and expensive for those of us in developed markets, the consequences for many people globally are far more severe. Billions of people around the world lack access to high-quality financial assets altogether, leaving them excluded from the benefits of modern finance.

While the fintech sector has improved the investor experience through automation of certain processes and better user interfaces, the problems above are fundamentally caused by limitations at the infrastructure layer and therefore are not well-suited to be solved by building on top of these existing systems. We believe that public blockchains and DeFi are best suited to address these issues while providing additional, novel features like programmability and composability.

As we thought deeply about the benefits of solving these issues, however, we came to believe that ultimately most of the benefits of public blockchains and DeFi come down to one thing—access:

- Access to capital wherever you are, enabled by better distributional infrastructure, including digital bearer assets like stablecoins.

- Access to financial products and services previously only available to wealthy or institutional clients, enabled by smart contract-based protocols.

- Access to custody and control of your assets, enabled by the use of private keys.

- The ability to grant or revoke access to your assets for various DeFi protocols (to lend against, trade, etc.) at whatever level of granularity you wish, through explicit permissioning.

- Access to these things whenever you want—including moving your assets to different DeFi protocols at any time—enabled by 24/7/365 operations.

- Access to the underlying infrastructure, allowing creation of new financial products and services, enabled by the permissionless nature of public chains.

It’s important to realize, however, that not all of this accessibility is achieved at once. Instead, it happens in fits and starts as technology evolves.

When Bitcoin launched in 2009, it was the first time any asset was made globally accessible to anyone with internet access at any time. With the launch of Ethereum in 2015, smart contracts enabled anyone to easily create new digital assets with similar accessibility. While tremendously powerful, these digital assets were disconnected from the ‘real world’ and thus often suffered from significant volatility and speculation.

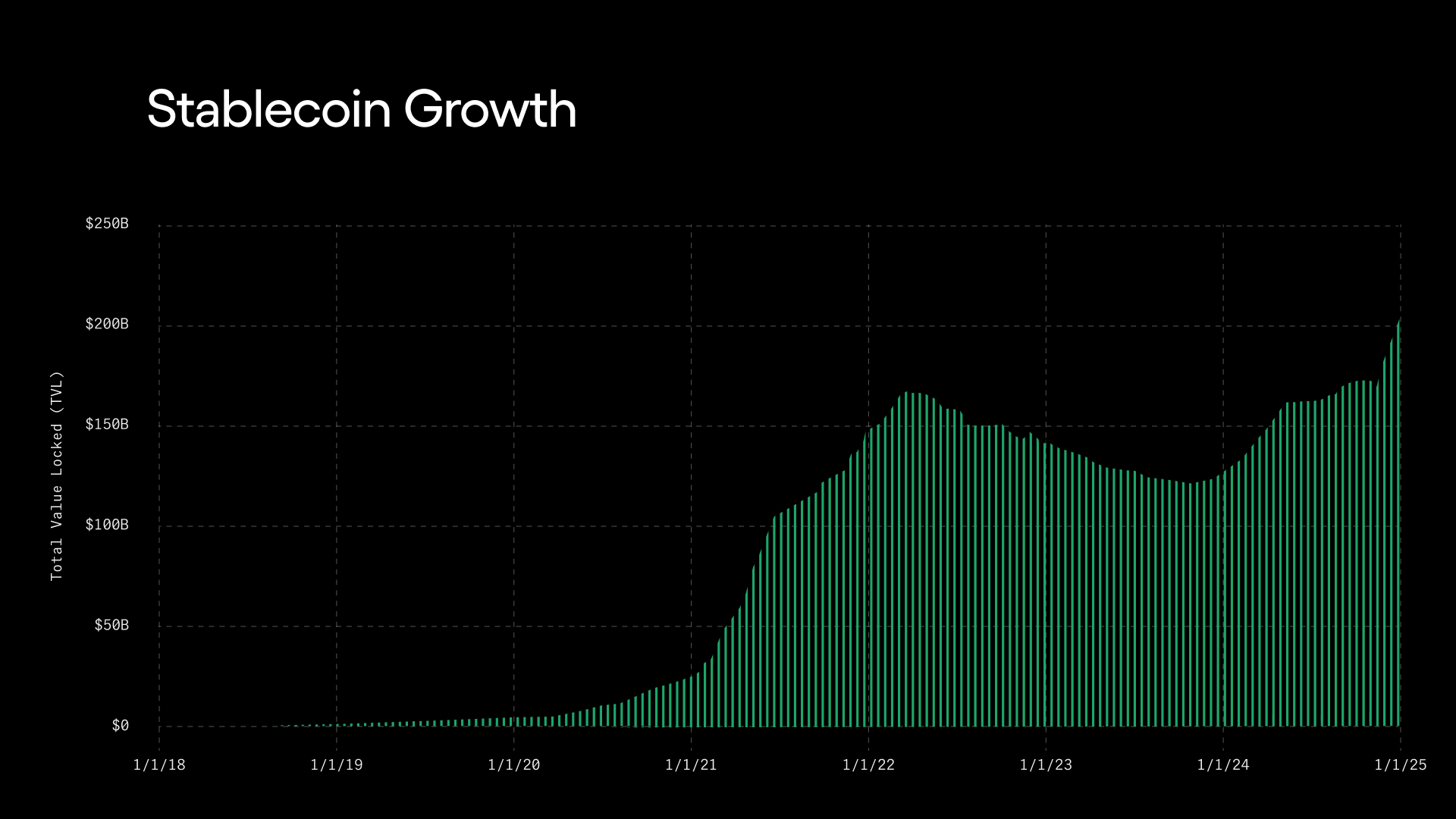

Tether changed this. Unlike ‘digitally-native’ assets, Tether leveraged blockchain technology to make exposure to a widely desired, high-quality, and stable asset from the real world—the US dollar—available to a global audience. Circle followed suit with USDC shortly thereafter. Since then, stablecoin usage has skyrocketed, with over $210 billion of stablecoins now circulating on public blockchains (Source: RWA.xyz).

The driving force behind this success is, once again, access—in this case, access to the US dollar. We in the US often take such access for granted. But for billions of people around the world living in countries with unstable currencies or despotic regimes, access to a stable and reliable asset like the dollar has been both desperately desired and difficult to obtain. Capital controls, frictions in opening a US bank account, and high foreign-currency exchange fees often made getting access practically impossible. Stablecoins have changed this. By leveraging blockchain technology, they make the US dollar accessible to anyone with an internet connection, anywhere in the world. Combine that with all of the other benefits that the blockchain enables—near-instant settlement, 24/7/365 access, and the ability to self-custody—and for many people in the world, stablecoins truly are a “10x” better solution.

Before the Breakthrough

As US dollar-backed stablecoins gained traction, it became clear that the same blockchain features enabling better access to the US dollar could also be applied to other 'real-world' assets (RWAs). However, early attempts to bring RWAs onchain faced significant challenges and struggled to gain widespread adoption for several reasons:

- Timing. A well-functioning market requires a sufficient number of participants. At the time, however, the technology was not yet proven enough for institutional investors, and many early crypto adopters were either focused on aggressive speculation of highly volatile digitally native tokens or were simply happy to finally be able to hold their wealth in a stable source of value through stablecoins.

- Lack of Utility. Beyond simply buying and holding, there were limited use cases for tokenized assets. Without a robust ecosystem to support lending, borrowing, trading, or yield generation, tokenized RWAs often became simply digital representations of value without much practical purpose. While the ability to ‘buy and hold’ does have inherent value, vibrant financial markets depend on the ability to dynamically deploy assets to create liquidity, generate returns, and facilitate transactions.

- Focus on Alternative Assets. Early tokenization efforts often targeted illiquid assets like loans and private funds, assuming that blockchain’s ability to enable fast, cheap settlement would improve their liquidity. However, liquidity in these assets is constrained not by technology but by deeper issues like information asymmetry, lack of fungibility, pricing challenges, and issuer resistance to liquid secondary markets. As a result, these efforts failed to gain significant traction.

For these reasons, tokenization efforts outside of stablecoins remained largely pilot exercises to demonstrate feasibility.

Time for Tokenization: The Emergence of Yieldcoins

In 2022, with rising interest rates in the real world and falling rates onchain, we identified in US Treasuries the first opportunity to tokenize securities that had a clear and immediate need. We tokenized US Treasuries to provide the market with a better alternative to conventional stablecoins—one that preserved the global real-time transferability and onchain programmability of stablecoins, while paying holders a yield.

To do this well, we knew we needed to focus on creating institutional-grade products. To us, “institutional-grade” meant (a) built and operated with security and transparency as bedrock principles; (b) designed for regulatory compliance; (c) thoughtfully structured, both in terms of cost-effectiveness and investor protections; and (d) supported by world-class customer and user experience. We also knew that “products” didn’t just mean tokenized assets; it also meant the protocols that would add utility to those assets and the infrastructure to enable all of this to work together securely, reliably, and seamlessly.

We started with OUSG. Built for institutional investors worldwide, we designed the token with embedded transfer restrictions, ensuring that only clients who successfully passed our KYC process could hold it. This design facilitated compliance with regulations. It also provided comfort to investors concerned about blockchain security and loss of funds; even if an investor were to be hacked, we would only ever redeem OUSG tokens to a verified party. We invested OUSG’s assets in a Treasuries ETF managed by BlackRock, the world’s largest asset manager. We partnered with best-in-class service providers and we provided daily transparency reporting into the full holdings and financials of the underlying fund, validated by a third-party fund administrator.

We also began to consider how users might access utility for their tokens beyond just buying and holding. So we developed Flux Finance (later sold to the Ondo Foundation and launched by the Ondo DAO), the first onchain Treasury repo market. Flux allows any OUSG tokenholder to pledge their tokens as collateral to borrow stablecoins. To support OUSG’s regulatory compliance—to ensure it was institutional grade—Flux was also the first DeFi protocol to support permissioned securities and ensure that fOUSG (the receipt token an OUSG tokenholder received in return for pledging their OUSG) could also only be transferred to those investors eligible to hold OUSG.

We then innovated again to ensure investors could get access when they wanted, by introducing instant minting and redeeming of OUSG tokens—24 hours a day, 7 days a week, 365 days a year. To make OUSG even more accessible, we also lowered the minimum subscription or redemption size from $100,000 to just $5,000.

—

While these innovations were a great first step, access to OUSG was still limited to high net-worth and institutional investors. This is why we then launched USDY, the first freely transferable yieldcoin, designed to be accessible to retail investors outside the US.

Like OUSG, USDY maintains institutional-grade standards. It requires KYC verification for non-US persons to mint or redeem tokens, with daily third-party verification of reserves. It maintains a quarterly target of 3% over-collateralization, and is designed for robust bankruptcy protections with a third-party verification agent and collateral agent. Unlike OUSG, however, USDY tokens can be transferred and held freely (outside the US and subject to certain jurisdictional and other restrictions) and can be purchased by retail investors directly from us in amounts as low as $500. And, like OUSG—but unlike stablecoins—USDY pays tokenholders yield just for holding it.

The Importance of Being “Institutional Grade”

Institutional investors and asset managers operate in a highly regulated environment where reliability, security, compliance, and scalability are non-negotiable. To move onchain, these investors demand that our solutions meet the same levels of thoughtfulness, transparency, compliance, and service they expect from existing financial systems.

At Ondo, we ensure that everything we build meets those demanding standards. No matter the dimension—from the design of our products to the partners we choose —we take extra care to ensure that what we do is best-in-class.

While the launch of USDY brought exposure to US Treasuries to a much broader audience, it was initially only available on Ethereum and still lacked utility beyond its stability and yield. So we focused on expanding USDY access across many chains, including Ethereum, Solana, Sui, Aptos, Mantle, Noble, and Arbitrum. We then built the Ondo Bridge, allowing users to seamlessly (and more securely) move their assets from one chain to another. In parallel, the composability of USDY enabled its integration by a broad range of partners custodians, DEXs, lending protocols, exchanges, perpetuals, payments providers, and more. (See the Ecosystem page of our website for more details.)

We’ve also seen tremendous growth within the yieldcoin sector as a whole. Many other companies have entered the space, including major traditional financial institutions like BlackRock and Wellington Management, attracting additional users and capital. Indeed, since the launch of OUSG 24 months ago, the total value of US Treasuries-backed products has reached almost $3.5 billion onchain (Source: RWA.xyz). By comparison, it took about 58 months after the launch of USDT for stablecoins to hit that same level.

We view this as a success. Bringing financial markets onchain is a collaborative effort that requires contributions from many stakeholders. Our approach has always been to develop platforms, assets, and infrastructure necessary to catalyze the movement of others into the space, whether simply by inspiring them to “join the movement” or by working with them directly.

As one example, we announced a new initiative of ours called Ondo Nexus, designed to utilize our OUSG instant minting and redemption technology to enable instant liquidity for issuers of other stablecoins and yieldcoins. As part of this initiative, we are diversifying the backing of OUSG to include yieldcoins from Franklin Templeton, Wellington, and WisdomTree, while leveraging liquidity from our existing relationships with BlackRock, PayPal, and others. We recently provided some public details with Wellington and FundBridge regarding their planned use of Nexus.

We love this example because it highlights so much of what we’ve been talking about: enabling instant redemption (improving access in time) to more people (improving access in reach) via more providers (improving access in choice), all enabled by the composability of tokenized assets.

Welcome to Wall Street 2.0

The industry finds itself at a pivotal moment. Stablecoins have been a tremendous success, with over $210 billion worth in circulation today. DeFi has flourished, providing significant utility for digital assets. User adoption has surged, driving demand for digital assets that can serve as both stable stores of value and sources of yield. Yieldcoins have demonstrated substantial growth (and are poised, we think, to take substantial market share from traditional stablecoins). Large traditional asset managers are beginning to bring their assets onchain. Yet despite this progress, the current investing experience for so many around the globe is still broken.

That’s why we believe that now is the time to bring a broader array of institutional-grade RWAs onchain.

To be clear, this market is enormous. There are over $867 trillion in traditional financial assets that can benefit from tokenization (source: CoinDesk). If done correctly—if done in an institutional-grade way—both the opportunity and the impact will be tremendous.

—

To better assess the impact of blockchain technology and asset tokenization on financial markets, it's helpful to first consider how modern financial markets—epitomized by Wall Street—have evolved over time.

Wall Street traces its origins to 1792, when 24 stockbrokers signed the Buttonwood Agreement, laying the foundation for what would become the New York Stock Exchange (NYSE). In those early days, financial transactions relied on manual processes and face-to-face trading. Deals were struck on trading floors, and extensive paperwork was required to finalize transactions. A web of intermediaries, including brokers and banks, was essential to facilitate these trades. This system was marked by high costs, limited transparency, and restricted accessibility.

The 20th century ushered in a wave of innovations that began to modernize the way Wall Street operated. The stock ticker, introduced in 1867, dramatically improved market communications, and the advent of the telephone in the late 19th century enabled faster information exchange. By the mid-20th century, advancements like the automation of trading-floor data signaled a shift toward more efficient systems. The 1970s saw the rise of electronic trading platforms, replacing traditional floor trading with digital systems that improved speed and accuracy. In the 1990s, the advent of the internet democratized access to financial information, reducing barriers for retail investors and lowering transaction costs. And most recently, high-frequency trading has driven liquidity and efficiency to new heights and the fintech boom has improved front-end user experiences for retail investors.

Yet, for all these advancements, the core structure of financial markets has remained largely unchanged. Centralized systems still dominate, with data siloed in proprietary databases and processes reliant on intermediaries to reconcile and settle trades. While digitization reduced some operational costs and streamlined processes, the fundamental structure—one reliant on intermediaries, opaque data flows, and restricted access—still persists.

Tokenization of real-world assets on public blockchains will change this. By making assets more accessible, transparent, and interoperable, tokenization represents a material improvement to the way financial markets function. It unlocks the potential for real-time settlement, reduced costs, and global accessibility while preserving the integrity and trust that traditional systems have long provided.

Importantly, unlike many of the early acolytes of blockchain technology, we don’t believe that this will result in the creation of a separate, techno-anarchist version of financial markets that operates outside of regulations, destroys all incumbent players, and fundamentally alters the way capital markets operate. Instead, we believe that blockchain technology represents a substantial advance in the infrastructure on which financial markets run, which materially improves efficiency, transparency, and accessibility. You might call it a foundational upgrade.

We call it Wall Street 2.0.

Wall Street 2.0 represents the next evolution of financial markets, where traditional systems converge with blockchain technology to create a more accessible, efficient, and inclusive ecosystem. Unlike the legacy financial infrastructure, which is siloed, slow, and heavily reliant on intermediaries, Wall Street 2.0 leverages tokenization, smart contracts, and decentralized protocols to enable seamless access to a wider range of assets, real-time settlement, and automated compliance. This new paradigm empowers both institutions and individuals to transact, invest, and build financial products with unprecedented speed, transparency, and flexibility—democratizing access to financial opportunities and lowering barriers to entry.

Consider just a few ways Wall Street 2.0 will benefit stakeholders:

Investors will get access to:

- Global Assets. Imagine you want to diversify your portfolio with foreign stocks or bonds. Today, you have to navigate currency exchanges, manage foreign brokerage accounts, and deal with different regulatory environments. On Wall Street 2.0, you can seamlessly invest in tokenized versions of foreign assets on a decentralized platform. With just a few clicks, you’ll have a globally diversified portfolio without the hassle.

- 24/7/365 Markets. Say you’re trading Asian equities and you see a compelling opportunity, so you want to exit one of your US-based positions held at a different broker. Today, you may need to wait until US markets open to make the trade. Even then, accessing the cash from that sale could take days or more, tying up capital and increasing your costs due to potential currency fluctuations and fees. On Wall Street 2.0, can sell the token representing that US position at any time and settle in seconds. You’ll be able to access and reinvest your funds almost immediately, making it easier to react to market changes without waiting on outdated financial infrastructure.

- Better Rates. Let’s say you (as a retail investor) have your portfolio at Schwab and want to borrow money against it. Today, you either have to borrow at whatever rate Schwab offers you or have to move your entire portfolio to another broker—often a multi-day process; you have no easy way to “shop around” for the best rate. On Wall Street 2.0, with a click of a button you can find the best rate across a range of lending protocols and quickly pledge your assets to get cash.

- New Investment Opportunities. If you’re a retail investor in traditional markets today, you are mostly limited to the existing financial products and strategies offered by your broker. On Wall Street 2.0, you can not only access (or create!) strategies not historically available to retail investors, but also earn fundamentally new types of yield (e.g., staking your securities for network security and getting paid a portion of the transaction fees). There are also opportunities to combine the best of digitally native and real-world assets (e.g., seamlessly cross-collateralizing staked ETH with tokenized securities to optimize borrowing rates).

Asset Managers will get access to:

- More Efficient Fund Administration. Imagine you're an asset manager looking to launch a fund. Traditionally, this involves coordinating with multiple intermediaries and bearing significant administrative costs. On Wall Street 2.0, you can issue a fund token with other tokenized assets as the underlying, reducing overhead and administrative burden.

- Broader Reach. Imagine you’re an asset manager wanting to attract investors from around the world. Today, regulatory barriers and jurisdictional complexities can make this difficult. On Wall Street 2.0, you can issue tokenized assets that comply with regulatory requirements and reach qualified investors globally through DeFi platforms, expanding your reach.

- Easier Compliance. Imagine you’re overseeing compliance for your fund, with constant KYC updates, AML checks, and reports to regulators—an endless paperwork challenge. On Wall Street 2.0, your tokenized assets have compliance rules baked into their smart contracts. These automations handle investor eligibility and ensure adherence to regulatory standards. Reporting is easier too, as investors can view asset performance, portfolio composition, and risk metrics anytime, without waiting for quarterly updates.

Developers will get access to:

- Easy Integration. If you want to build an application on top of today’s financial system, it’s a maze of permissions, access requests, and API integrations. Every step involves securing authorizations from banks, navigating opaque systems, and working through intermediaries to access user data. On Wall Street 2.0, that complexity is drastically reduced. By leveraging decentralized finance protocols, you can seamlessly tap into an ecosystem where assets, data, and services are open and interoperable. This streamlined access enables you to develop and deploy financial applications faster, eliminating the traditional gatekeeping that slows innovation.

- More Assets. Imagine developing an app where users can manage portfolios, but you’re limited to digital assets, which can be volatile and restrict who might use your product. In Wall Street 2.0, you can integrate tokenized real-world assets—like stocks, bonds, and ETFs—directly into your app, providing more stable options and expanding your user base. This flexibility lets you create applications that appeal to both retail and institutional investors looking for a wider range of asset choices.

- Built-in Compliance. Imagine you’re creating a financial app. It needs to include compliance checks like KYC/AML, which adds manual work and operational costs. On Wall Street 2.0, you can embed compliance rules directly into smart contracts, allowing user verification and transaction monitoring to occur automatically. This built-in automation ensures regulatory adherence with minimal friction, giving you the flexibility to scale your app while reducing the burden of regulatory overhead.

These are just some of the things that are possible on Wall Street 2.0. By fostering real-time transactions, interoperable assets, instant compliance, and accessible investment options, this evolution will equip investors, asset managers, and developers alike with tools to transact, trade, and collaborate with new freedom.

Bridging the Gap

To be clear, we’re only at the start of this new world, with much work yet to do. For example, it’s certainly the case that issuing and managing a tokenized version of a real-world asset today is more expensive than its non-tokenized counterpart; until infrastructure and legal structures further mature, operations and accounting of tokenized assets have to happen both in the real-world and onchain. While there are other benefits of holding tokenizing assets, at least today lower costs are not typically one of them. While becoming increasingly favorable, there is still a multitude of global legal and regulatory regimes that need to be navigated, which can both restrict access and add frictions to asset issuers, protocols, and investors alike. The underlying technologies, though rapidly advancing, still have room to improve across many dimensions, including speed, cost, security, and user experience. The operational challenges of bridging a world that operates instantly, globally, and 24/7/365 with a world that does not are often nuanced and complex. User interfaces are often still clunky and ill-suited for mass adoption. And the business models of many providers in the ecosystem are still unproven, with many stakeholders still uncertain where—and to whom—value will accrue.

For almost two years, we’ve been deeply focused on addressing these challenges and bringing institutional-grade RWAs onchain. One key realization we’ve had is that building robust capital markets onchain requires focusing not just on the assets, but also on the infrastructure that underpins the entire market. As we’ve said from the beginning, this undertaking is far too big to accomplish alone—it requires the support and collaboration of many key partners to build an ecosystem that can bring this vision to life.

That’s why, over the past year or so, we’ve been working hard to bring together the pieces—the assets, the infrastructure, and the ecosystem—to make this vision of onchain capital markets a reality.

Access for All: The Foundation of the Open Economy

Until now, we’ve described the main benefit of blockchain technology as increasing access. But if we think about all of the features—the ability to make, consume, use, and transfer financial assets wherever you want, whenever you want, all in an (appropriately) transparent way—another word also comes to mind: open. What public blockchains enable—what stablecoins have started and what Wall Street 2.0 represents—is the beginning of the transition to a more open financial system.

We believe that this move towards a more open financial system is very much in line with the general thrust of the incoming US administration. As we have stated elsewhere, we understand and respect the need for regulation and investor protections. But we also believe that people should have access to high-quality, regulated financial assets and services, regardless of wealth or income level, and that people should have the right to move and use those assets easily and as they see fit. We believe that improving access to US financial assets is good for the US: DeFi will open up a broader array of financial services to individuals who previously could not afford them, and greater access to US assets will allow the global demand that already exists for them to finally be met. We also believe that broader access will enable more shared participation in the value that global supply chains bring: if a worker in Vietnam assembling Nike shoes can also own—easily, instantly, and cheaply—Nike stock and more fully participate in the value she creates, we think that’s a good thing.

—

We’re tremendously excited about all of this, but it’s only one part of a bigger shift we’re seeing. The use of stablecoins and yieldcoins for cross-border remittances or point-of-sale payments is reducing transaction costs and expanding access to the goods and services purchasable with these assets. The incredible advances in AI are increasing access to intelligence and low-cost knowledge work, not to mention the value creation and capture that will occur when AI starts earning and allocating capital onchain. And, of course, the bedrock of this all, the internet, has long been making information more accessible—more open—to all. This isn’t just about a more open financial system—it’s also about broader access to goods, services, intelligence, and information. There’s a word for that: the economy. The open economy.

The open economy is an idea that reaches beyond the financial system: it’s a vision of a globally accessible system where goods, services, and information flow freely. Enabled by technology, the open economy moves us toward a world where barriers to accessing capital, goods, and information are minimized, empowering individuals and organizations to engage as producers, consumers, makers, and citizens in ways that historically have been out of reach for many.

This paradigm shift brings numerous benefits: universal access to goods and services through decentralized marketplaces, democratized access to information via blockchain-powered platforms, decentralized platforms for direct exchange of goods and knowledge, and enhanced privacy and security through cryptographically enhanced systems. By removing geographic and bureaucratic constraints, the open economy fosters economic inclusion, lowers barriers to knowledge and education, and gives individuals greater control over their personal data across various sectors including finance, healthcare, and education.

The open economy isn’t just an evolution in how we access capital; it’s a fundamental shift in how individuals and organizations globally engage with the entire spectrum of economic life. Yet a strong economy vitally depends upon—and is enabled by—its financial markets to support the efficient formation, allocation, and movement of capital; the management and distribution of risk; the facilitation of payments; the storage and growth of wealth; the provision liquidity and credit; the facilitation of price discovery; the support of economic activity; and the encouragement of entrepreneurship and innovation.

Our mission is to accelerate the transition to the open economy by building the platforms, assets, and infrastructure to bring financial markets onchain.

To reflect this updated mission, today we’re introducing a new visual identity for our brand. You can explore this new look and feel on our website.

We’re incredibly excited to be on this journey. With the help of our clients, partners, and investors, we’ve made tremendous strides towards our mission. But we think the best is yet to come. With accessible goods and services, open information flows, and secure data ownership, the open economy is poised to reduce economic inequality, enhance productivity, and promote social mobility. From sourcing goods to finding work, gaining education, securing health data, and (of course) accessing and deploying capital, the open economy enables individuals everywhere to participate more fully and equally in the economic aspects of our global society—making it fairer, faster, and more accessible to all.

Onward.